Summary

Many organizations see “good enough” data pass through finance unchecked, but the real cost runs deeper than a few restatements. This piece debunks the myth that nearly-right data is safe. It shows how poor standards erode trust, slow growth, and expose companies to unnecessary financial risk.

The Myth

The myth is simple. “If my numbers are close, that’s good enough.” Many believe small discrepancies or unverified entries won’t impact financial decisions, compliance, or reputation—until they do.

The Truth

In reality, every gap between “good enough” and “right” adds invisible risk. Inaccurate or incomplete data leads to bad tactical moves, regulatory penalties, and cascading doubt, both inside and outside the organization. Modern financial systems demand more: the pace of decision-making, complexity of regulation, and widespread automation mean a minor slip can have major effects.

Evidence: What Goes Wrong When “Good Enough” Isn’t

- Misclassified expenses or missing transactions distort real profitability. This creates misleading financial reports that may guide management away from good opportunities or into costly mistakes.

- Manual data entry errors and duplicates silently erode trust. Even high-profile firms experience blowback: a survey found 65% of finance pros have worked at organizations that restated earnings due to hidden inaccuracies. For 41%, data quality problems reduced access to capital and increased their debt.

- Compliance failures mount fast. In banking and other regulated sectors, ongoing quality monitoring and escalation practices are now the norm.

- Headline disasters: Equifax’s 2022 error, caused by a “good enough” approach to server maintenance, resulted in over 300,000 credit scores being off by 20+ points. The company faced lawsuits and reputational damage—an error rooted in unreliable reporting processes.

Why It Happens

The “good enough” mindset often creeps in due to:

- Tight deadlines and quarterly reporting pressure.

- Overreliance on manual data entry and spreadsheets.

- Disconnected systems where reconciliation and validation are weak.

- Lack of ownership for data accuracy within finance teams.

How to Raise the Bar

1. Build a Data Quality Framework

- Put clear data quality controls in place: validation checks, exception reporting, reconciliations, and a living data dictionary.

- Frequent internal audits and escalation procedures catch errors early.

2. Standardize and Automate

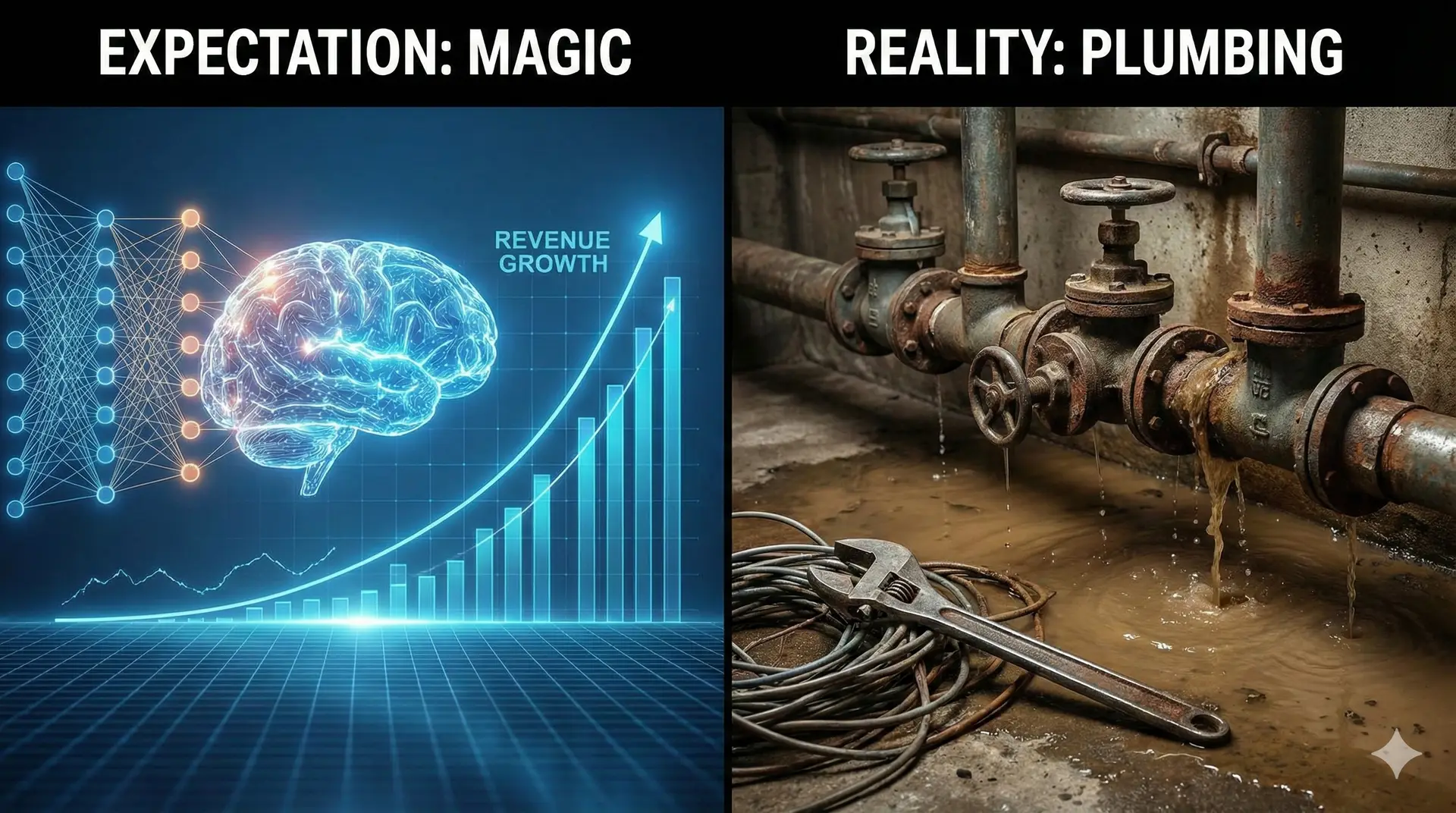

- Move away from manual entry where possible. Automation (AI-powered or rule-based) reduces human error and unifies formats.

- Create integrated reporting systems to ensure consistent data flows, even across legacy platforms.

3. Assign Accountability

- Establish data owners for all business-critical reports to drive accountability and continuous improvement.

- Use dashboards that highlight errors and progress, encouraging open dialogue and action.

4. Ongoing Training

- Make sure both new and experienced staff understand the business impact of “small” data slips. Leverage regular training on both systems and finance policy.

Takeaway

“Good enough” in financial data is not simply a missed opportunity—it’s a liability. Raising the bar requires structure: controls, automation, ownership, and training. Organizations that demand higher standards see better business outcomes, deeper trust, and greater resilience to both regulatory scrutiny and market shifts. Now is the time to push beyond “close enough” toward truly trusted reporting.