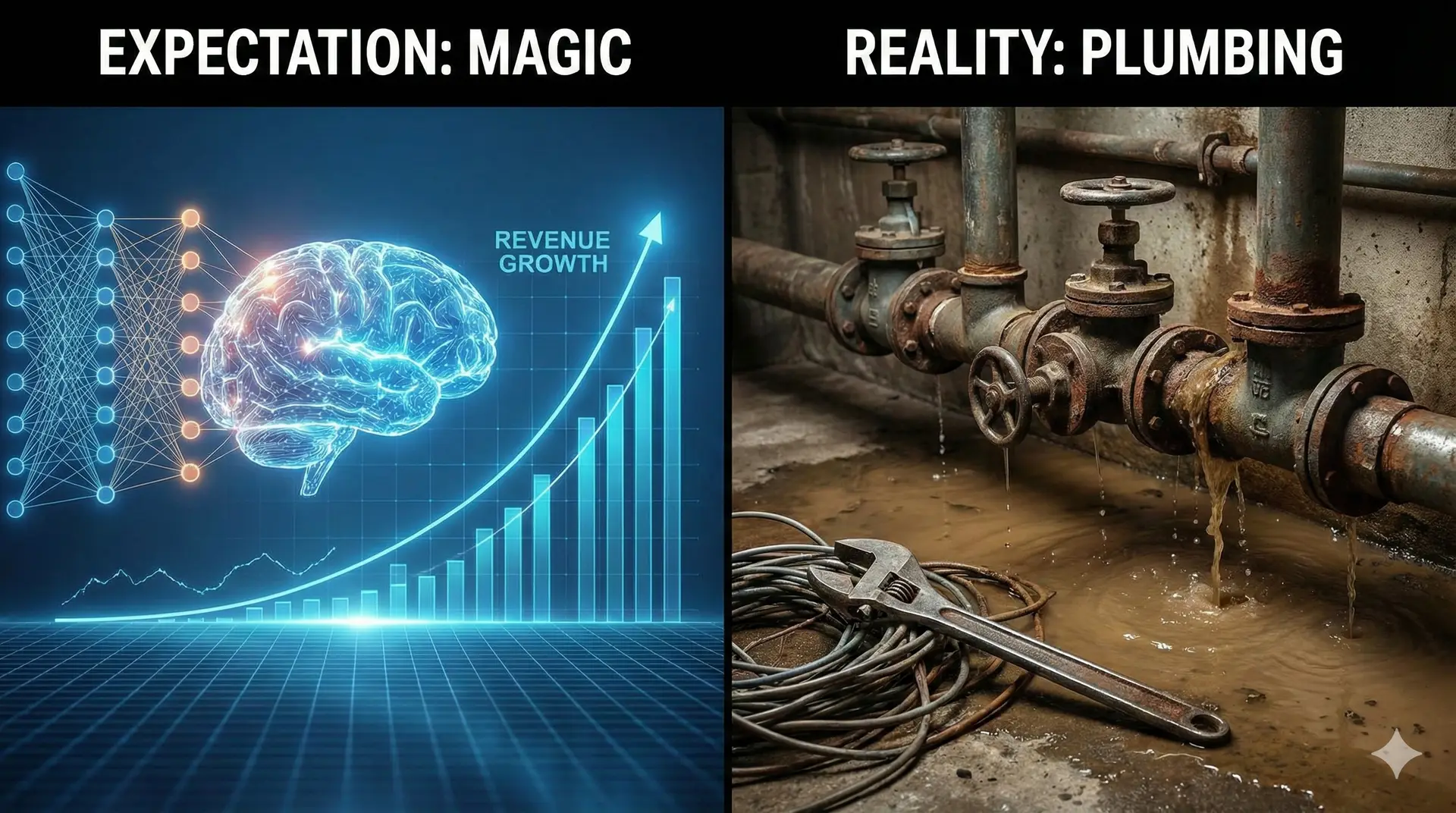

Summary: Why Data Transformation Matters

Today’s CFO faces more pressure than ever to drive not just financial efficiency but meaningful business transformation. Modern finance leaders know that better-managed data unlocks growth, improves reporting, and supports risk reduction. In a recent Deloitte survey, 91% of CFOs said their companies would undergo more digital transformation in five years than in the past five—a shift powered largely by data initiatives.

Before: Barriers to Value

A mid-sized manufacturing business struggled with fragmented sales, inventory, and customer data across multiple platforms. Each month, the finance team spent almost two weeks reconciling numbers from separate spreadsheets. Analytical projects were slow and accuracy suffered, with sales and operations doubting the validity of key performance indicators. High costs, long lead times, and duplicated work slowed decision-making and led to missed opportunities.

Change Made: Centralized Data Platform and Modernized Processes

Leadership recognized the costs and risks of this status quo. The turning point came with the move to a centralized master data management (MDM) platform—a single system to pool sales, finance, and operating data. This change wasn’t only technological. It involved building new internal data standards, automating manual reconciliations, and training teams on the new system’s dashboards.

The CFO drove this transformation with three actions:

- Partnered with IT to select and implement a cloud-based MDM solution.

- Led company-wide training, focusing on data quality ownership for business users.

- Reworked reporting processes, moving from monthly to weekly automated dashboards and requiring less human intervention.

After: Tangible Results and New Business Value

The impacts arrived quickly after implementation:

- Speed: The monthly close process fell from 10 business days to just 5, freeing staff for higher-value analysis.

- Accuracy: Discrepancies and rework dropped by 70%, and reconciliations flagged fewer anomalies.

- Growth: Leaders could spot underperforming areas and respond weeks faster, with more trust in the numbers.

- Compliance: With cleaner data, the team passed internal audits on the first attempt—saving more than $250,000 in external consultant fees in the first year.

- ROI: Data analytics is a proven value driver: 25% more likely to meet/exceed financial goals, 15% more profitable, and 10% more efficient, according to Aberdeen Group and finance analytics studies.

Why It Worked: Broad Alignment and Business-Led Change

This win happened because the CFO aligned technical change with business needs:

- The focus stayed on ROI and risk, not on technology alone. CFO-led prioritization of financial value kept teams motivated.

- Training made data ownership part of everyone’s job—from sales to operations to finance.

- Automation wasn’t just about closing faster. Clear dashboards powered smarter, proactive business moves.

- Leadership kept the metrics simple. Productivity, error rates, and close times showed value, and regular check-ins sustained adoption.

What CFOs Should Ask Next

- Are manual workarounds still the norm in our reporting cycles?

- Is there a clear owner and standards for every business-critical data set?

- Are team members trained to spot and escalate data anomalies?

- Do analytics projects directly tie back to our business and financial goals?

Closing: The Path Forward

Data transformation is not just for IT or analytics teams—when a CFO leads and aligns it with business value, gains are substantial and enduring. The right data platform replaces silos and manual headaches with trust, speed, and strategic insight. The companies that succeed will be those that keep data integrity, automation, and business alignment at the core of their finance transformation agenda.