Few markets have commanded as much attention as AI in 2025. As headlines tout new breakthroughs and record capital inflows, many leaders are asking: Are current AI valuations justified, or are we repeating the cycle of tech-driven market bubbles? Likewise, practical businesses need clarity: What is genuinely working beyond the noise, and how can organizations set themselves up for AI success as the market matures?

This article addresses these questions through the dual lenses of financial analytics and operational expertise.

Market Snapshot: The Numbers Behind the AI Surge

• The global AI market is valued at $391 billion in 2025, almost quadrupling from $50 billion in 2023—an unprecedented pace driven largely by adoption of generative models (GrandViewResearch, 2024).

• The U.S. leads in private investment: $109.1 billion in 2024, dwarfing China and the U.K. (Stanford HAI, 2024).

• Growth looks set to continue, with industry forecasts projecting a 31.5% annual compound rise through 2033, reaching $3.5 trillion (GrandViewResearch, 2024).

Valuations: Where Opportunity Meets Risk

This breakneck growth stokes both excitement and apprehension. The recent slide among AI equities revived comparisons to the dot-com era, where remarkable promise was often overshadowed by unbridled speculation (CNBC, 2025).

• Market Correction Risks: Goldman Sachs cautions about a likely 10-20% equity market correction within the next two years, underscoring that AI stocks—some trading at revenue multiples exceeding 20x—are not immune. Market enthusiasm is fueling the rapid proliferation of startups, a classic precursor to bubbles (CNBC, 2025).

• Overvaluation Patterns: Analyst consensus highlights that some AI valuations have outpaced initial revenues or measurable impact. This pattern echoes historical bubbles, but it is crucial to recognize that each cycle brings new fundamentals.

Beyond the Bubble: Practical, Measurable AI Value

While risks exist, the pragmatic evolution of AI is both real and accelerating.

• Manufacturing: Predictive AI solutions are already delivering real ROI, cutting machine downtime and preempting costly breakdowns.

• Healthcare: 32% of German businesses, and an increasing share of U.S. healthcare providers, have embedded AI into diagnostics and patient care workflows, producing both efficiency gains and improved accuracy (Cargoson, 2025).

• Retail and Logistics: One in three UK marketers now rely on AI to optimize customer journeys, reflecting broader enterprise adoption (Cargoson, 2025).

• Productivity and Search: Recent studies find that visitors from AI search are over 4 times as valuable as those from traditional search, and enterprise adoption of advanced AI platforms is accelerating digital transformation (ExplodingTopics, 2025).

Critical to these successes is alignment between AI initiatives and organizational strategy; mere experimentation is insufficient without a focus on outcomes and foundational enablement (McKinsey, 2025).

The Data Imperative: Laying the Foundation for AI at Scale

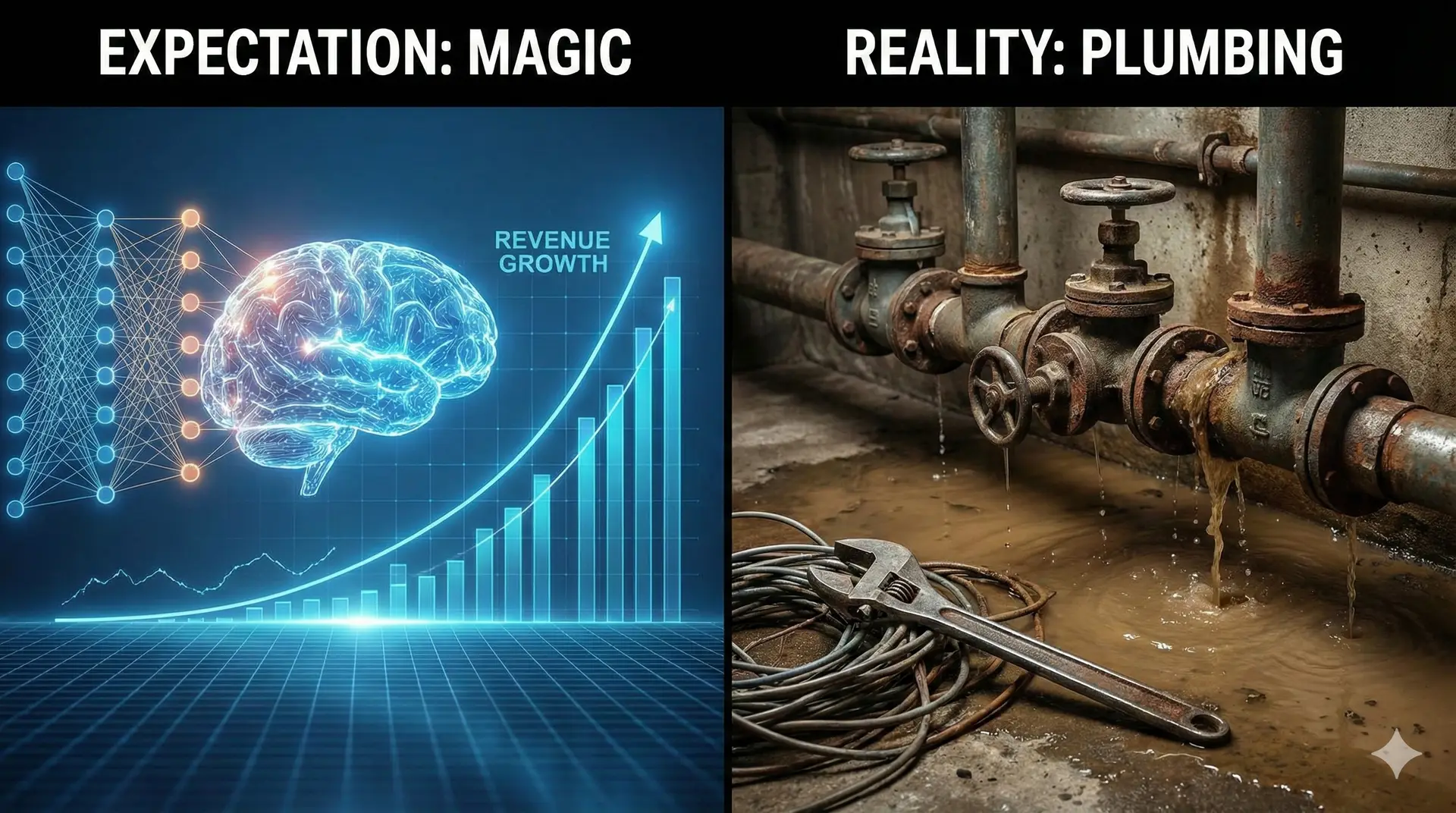

Across every successful AI project, a consistent theme emerges: robust data infrastructure is the difference-maker. The most sophisticated algorithms or largest language models remain ineffective without comprehensive, well-governed, and interoperable data. Foundational data work—cleaning, linking, and cataloging data assets—transforms AI from theoretical promise to operational powerhouse.

Organizations investing now in data quality, integration, and governance will reap significant compounding benefits as AI capabilities mature. As seen in our client projects, those with strong “data plumbing” convert new AI offerings into actionable insight quickly, gaining competitive advantages in cost reduction, revenue growth, and agility.

The Risk of Correction: Healthy, Even Necessary

Is a market correction coming? History suggests it’s possible—and, arguably, a necessary step in maturing any frontier technology. Corrections typically separate speculative ventures from sustainable operators. We already see industry leaders shifting focus to durable, revenue-generating solutions, not just blue-sky prototypes.

Conclusion: The Strategic Opportunity is Now

There has never been a more critical moment to invest in data infrastructure. While the AI market contends with headline volatility and real risk, the longer-term business opportunity is clear. AI’s true potential unfolds for organizations that treat data as a foundational asset, embedding analytics and governed processes at the heart of their operations.

As the hype gives way to pragmatic adoption, leaders who invest in these building blocks today will position themselves to harness AI’s growing list of practical, high-value applications in the future. The winners of tomorrow’s AI economy are preparing right now.

Don’t let indecision or headlines dictate your strategy. Review your organization’s data maturity, build the right foundation, and partner with experts who understand both the financial and technological realities of AI. The future belongs to those ready for it.

With decades of experience building robust, scalable and adaptable data foundations, Locadium helps organizations turn complexity into clarity. Schedule a complimentary consultation to ensure your business is ready for what’s next.

References

• Cargoson. (2025, September 25). How Big is the AI Market? https://cargoson.com/blog/how-big-is-the-ai-market/

• CNBC. (2025, November 7). AI valuation fears grip investors as tech bubble concerns multiply.

• Exploding Topics. (2025, June 15). 44 New Artificial Intelligence Statistics.

• GrandViewResearch. (2024, October 31). Artificial Intelligence Market Size | Industry Report, 2033.

• McKinsey. (2025, November 4). The State of AI: Global Survey 2025.

• Stanford HAI. (2024, September 9). The 2025 AI Index Report.